You’ve been involved in a car accident, or you’re involved in a dispute against your Long Term Disability Insurer. The adjuster for the insurance company tells you over the phone, or in an incomprehensible letter that they want you to attend a medical examination with a doctor you’ve never heard of.

You don’t know who this doctor is.

You don’t know where their office is located.

You don’t know how you’ll ever get there because transportation has been difficult for you since your accident or disability.

You don’t know why you have to attend the examination.

You don’t know what the examination is for, how long it will last, what tests will be administered.

You have about a million and one other questions about the examination, and you have nobody to turn to.

Enter a Personal Injury Lawyer.

These sort of questions arise in most personal injury cases.

For starters, in car accident cases, the Insurance Act, which is the law governing car accidents permits for insurance companies to arrange for these “Independant Medical Examinations” or IMEs.

They are called “Independant” examinations to give the air that the assessors performing the examinations are non biased.

In my experience, these examinations are not only biased, but they are completely unfair and totally intrusive for accident victims and disability claimants.

That’s why at my lawfirm, we refer the these “independent” examinations as “insurance” examinations. Afterall, the insurance company selects the examiner, selects the location, pays of the examination, and pays for the report generated for the examination.

You will quickly find that the doctors or assessors who peform these sort of examinations have the bulk of their practice devoted to such examinations, and NOT OHIP. That means that they’re working almost entirely for private insurers and rely on their return business instead of relying on the publicly funded OHIP system.

That ought to tell you something.

Good business says that you don’t bite the hand that feeds you. The doctors and assessors performing such examinations aren’t stupid. In fact, they are hightly intelligent and good business people. And as such, they want more business and return business. If they write a report the insurer doesn’t like, or is contrary to their position, the chance of getting their return business decreases. This is what takes the “independence” out of said examination.

As a client of mine recently stated not only to me, but also to an assessor:

“How can you be independant if the insurance company has not only selected you to perform the examination without my consent, but is also paying 100% of your bill? If this were politics, you’d be kicked out of office for having a conflict of interest“.

Very good points. All of them.

So if these examinations are totally biased in the favour of the insurer, then why must I even attend?

Another good question.

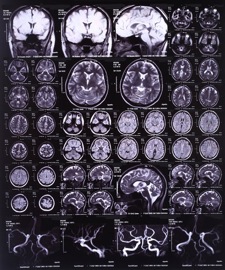

First: you never know what the report is going to say. Sometimes, the report comes back in favour of the accident victim. But, more often than not, the assessor’s report will say that your injuries are minor, that they have healed or will likely heal in the next few days, and that whatever benefits you may be entitled to should not be paid because you’re not injured enough to claim such an entitlement. Even the most catastrophically brain injured accident victim or disability claimant will see such a report. In any event, you never know what the report is going to say, so you should go if your lawyer says so.

Secondly: There are provisions in the Insurance Act which state that if you fail to attend such an examination, that you will be deemed non compliant or in breach of your policy. Once you’re deemed non compliant or in breach, then the insurer has a right at law to deny the benefit. Speak with your lawyer about this because sometimes, it’s still a good idea NOT to attend these examinations if the insurer is just trying to pad their file with denial after denial after denial. Your attendance at another examination in such a case will only further hurt you and your case. But only your lawyer can make such a decision.

If you are a Long Term Disability Claimant, there will likely be a section in your LTD policy stating that if the insurer requests that you attend an assessment with an doctor/examiner of their chosing that you MUST attend. Failure to do so will results in benefits continuing to be denied and will further justify their denial as you will be in breach of their policy. At the end of the day, if you want THEIR MONEY, under THEIR policy which THEY drafted in THEIR favour; then sometimes you have to play under THEIR rules. The cheaper the policy, the more one sided it will be in the insurer’s favour. I’ve seen a number of policies from Great West Life, Desjardins, Manulife, SunLife, Standard Life, Industrial Alliance, and SSQ have some very onerous provisions against disability claimants and in favour of large, deep pocketed insurers. It’s not fair, but these policies were NOT created with fairness in mind. They were created to give you an illusion of security along with an illusion of eligibilty to benefits. The reality is that these LTD policies are full of loop holes and landmines created by lawyers to DEFEAT your claim and NOT approve your benefits. Particularly LTD policies which are part of your benefits packages through work. Your employer will opt for the cheapest policy to provide the illusion of a benefit. The cheaper the policy, the more skewed it will be in favour of an insurer. In addition, employer based policies are only offered through work. If you leave their employ, the policy no longer follows you (depending on your severance package). With your own private policy, that will follow you from job to job to job.

Want a good LTD policy? Purchase one on your own through a broker. Make sure that the definition of disabilty remains “OWN” occupation throughout the course of the policy instead of changing to “ANY” occupation at the 2 year mark. Then inquire about the percentage of benefits which you’re entitled to. If it’s just 66% of your NET income and the benefit is taxable, then it’s NOT good enough. You want a benefit percentage as high as possible, and for that benefit to be NON TAXABLE. That way, if you get approved for LTD benefits, you won’t have to pay the tax man for the LTD benefits which come your way. Most group policies offered through work are taxable, meaning that you get less money in your pocket.

Thirdly: The assessors who prepare these reports often have boiler plate reports. Having practiced in the field of personal injury law for over 11 years, I’ve seen countless of these boiler plate reports. We collect them. We compare them. We show the (with appropriate redactions) to adjusters, judges, and arbitrators. Once they see these fill in the blank boiler plate reports, their stomachs begin to turn. It’s an instant reaction. Those are the types of things which get insurers thinking twice before using that assesor again, or denying your claim.

Finally: Once in litigation, there is a provision under s. 105 of the Courts of Justice Act, and a provision under Rule 33 of the Rules of Civil Procedure in Ontario which permit for a defence medical examination (or insurance examination). If you fail to attend, your case may get dismissed by the Court. If the insurer wants a 2nd or 3rd examination, they will have to seek permission to do so from the Court. Examinations conducted pre-litigation will NOT count.

Our law firm cannot possibly answer all of your questions about IMEs with this Toronto Injury Lawyer Blog Post. There are simply too many things to go over, too many scenarios, and you likely have too many questions. But, we hope this Blog Entry did clear up a few things. If you continue to have such questions, feel free to contact us by email at info@goldfingerlaw.com or toll free at 1-877-730-1777. All consultations are free.

How about Toronto’s sports teams? Hockey team? Fail. Basketball team? Hot and cold. Soccer team? HOT HOT HOT. Looking forward to seeing what the new additions are capable of throughout the course of an entire season. Dare I say playoffs for the first time ever? Lesson: sometimes when you spend the money, the results will follow.

There was a bomb threat today at our Toronto office. The buildings at 45 and 47 Sheppard Avenue East were evacuated. Police attended at the scene. No cars were allowed to enter or EXIT the above ground or below ground parking lots. Scary sight. Scary that we had to evacuate not knowing what was happening. We closed our doors early today because the building shut down. I’m not sure if it’s since re-opened. In any event, when you share a building with the Family Court, Small Claims Court, OHIP Offices, ODSP Offices and Ontario Landlord Tenant Tribunal, these sort of threats may happen. We’re all safe here at Goldfigner Law, and there are no reported casulaties or injuries.

Toronto Injury Lawyer Blog

Toronto Injury Lawyer Blog