Did you know that your car insurance coverage for accident claims is changing effective June 1, 2016?

If you’re answer is “NO“, then you’re not alone.

To be frank, the only reason I know about these changes is because I’m a personal injury lawyer and it’s my job to do so. But if you’re reading this Toronto Injury Lawyer Blog Post, chances are you’re not a personal injury lawyer like me, and these changes are new to you.

Why are these changes being introduced in the first place?Good question!

I didn’t ask for them…. You didn’t ask for them…..

The only people who asked for these changes were the car insurance companies and their lobbyist group in order to save them MONEY. These changes aren’t about you ,the consumer. They aren’t about protecting the public. They’re about making MONEY for those large, multi-national corporations who provide insurance services in Ontario.

The logic is that the savings for large, deep pocketed insurers are supposed to be passed along to the average, every day, Ontario motorist. These changes have been coming fast and furious to save insurers money.

Yet, in Goldfinger Injury Lawyers’s informal poll of 10 drivers asked in Toronto; 10 drivers asked in Peterborough; 10 drivers asked in London; 10 drivers asked in Kitchener; and 10 drivers asked in Vaughan; NONE OF THEM REPORTED ANY SAVINGS ON THEIR CAR INSURANCE IN THE PAST 3 YEARS!! The only savings that were reported were from those motorists who stopped driving, or instead of insuring 2 vehicles, they new only insured 1 vehicle. Conducting these polls was very easy for our law firm because we have offices in all of these Cities, with the exception of the City of Vaughan.

Now, let’s talk about the changes to accident benefits under your standard, Ontario, car insurance policy which you need to know.

- Cuts to Non-Catastrophic benefits from the current total of $86,000 ($50,000 for med/rehab and $36,000 for attendant care), down to a combined total of $65,000. This represents a reduction in benefits of $21,000 or around 24%.

- Cuts to the duration of non-earner benefits to a maximum of 2 years. Prior to June 1, 2016, non-earner benefits were paid for a lifetime. This savings to the insurer is huge as the maximum exposure per non-earner benefit claim is just $18,500

- Cuts to catastrophic benefits from $2,000,000 ($1,000,000 in med/rehab benefits and $1,000,000 in attendant care benefits) down to just $1,000,000. This is a 50% reduction!

- Cuts to the definition of what it means to be found catastrophic under the SABS such that the Glasgow Coma Scale will no longer be used to test for CAT brain injuries. In the past, when there was a GCS-9 or below rating, that person would be found CAT relatively quickly. Now those GCS ratings are meaningless. This results in increased delay for accident victims to get catastrophic benefits, and increased costs to innocent accident victims.

These are the most significant changes which are taking place June 1, 2016, but there were more changes introduced in the first quarter of 2016 if these weren’t enough for you to process. Highlights of some of these earlier changes include, but aren’t limited to:

- Cuts to your ability to sue your own insurance company in open Court over their failure to pay accident benefits. You can no longer sue your own insurer if they aren’t playing by the rules!

- Cuts to your ability to sue the at fault driver on account of increased deductibles for pain and suffering claims. If your pain and suffering isn’t over $36,920, then your claim is without any value on account of the deductible. That deductible increases every year to reflect inflation, yet your income replacement benefits, non-earner benefits, and med/rehab benefits

- Cuts to the Financial Services Commission of Ontario (FSCO) such that this governmental body doesn’t even hear accident benefit claims anymore. The result is that now claimants can’t get a free FSCO mediation, or have an Arbitration before an experienced an knowledgeable trier of fact. Claimants also have to pay $100 to have their accident benefit disputes adjudicated before the LAT, instead of having those same disputes heard for free at FSCO.

- Cuts to pre-judgment interest rates for car accident tort claims which save insurers money and help to minimize their exposure and maximize profits

- Cuts to interest rates for accident benefit disputes such that interest is no longer compounded for wrongly denied accident benefits. Instead, the Courts of Justice Act Interest rates apply, which are in the range of 1%. Compound interest rates used to apply to insurers as a way to protect consumers and encourage insurers to pay in a timely manner. Instead, now insurers can make more money investing the denied benefits and paying out at 1% interest down the line. This is a total windfall to the insurance industry.

Notice how every change was in favour to the insurer. They were all pretty much cuts to coverage for innocent accident victims. Not one change introduced effective June 1, 2016, or in 2016 for that matter will serve to protect drivers. These changes are at the expense of the general public in favour of political patronage. Did you know that the Insurance Bureau of Canada (the lobbyist group that represents these insurers), were #4 on the list of Ontario’s largest political donors at $315,310 since 2013 according to a Globe & Mail study.

If the cards weren’t stacked against car accident victims already, these new changes which will be introduced on June 1, 2016 will certainly tip the scales of justice even more so in the favour of insurers. These legislative changes, in conjunction with the inherent spending power imbalance between and insurer and an every day motorist don’t equal justice served. On the contrary, this is a travesty and was certainly not what the provincial government had in mind when it introduced no fault accident benefit legislation to Ontario in the 70’s and 80’s. The consumer protection intention of the legislation has been completely eliminated in favour of political and financial gains.

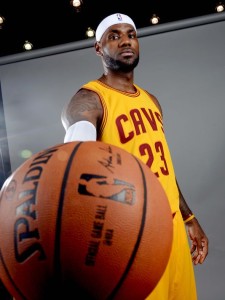

Enough law talk? Sure. Congrats to the Toronto Raptors on not only advancing to the Eastern Conference Finals, but making it a competitive series. We here at Goldfinger Injury Lawyers are so proud of everything the Raptors have accomplished this season. Having been a fan since Day #1 when they played in a cavernous corner of the SkyDome, to where they are today, it’s quite a feat. Let’s hope they continue this great playoff run and continue to make basketball fans across Canada proud.

Toronto Injury Lawyer Blog

Toronto Injury Lawyer Blog